interest tax shield calculator

Interest paid on the home loan can be claimed as a deduction under Section 24b up to INR 2 lakhs. You must be legally responsible for repaying the loan to deduct the mortgage interest.

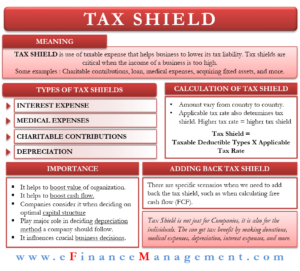

Tax Shield Formula Step By Step Calculation With Examples

So you can claim tax benefits on the owned home as well as on the rented one in the following manner Principal repayment of the home loan can be claimed as a deduction under Section 80C up to INR 15 lakhs.

. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Learn more about the mortgage interest tax deduction here.

Heres what you should know. Who qualifies for the mortgage interest tax deduction. Claiming the Child Tax Credit.

If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying residence including your.

Tax Shield Calculator Efinancemanagement

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Calculator Efinancemanagement

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula Excel Calculator

Tax Shield Calculator Efinancemanagement

Tax Shield Formula Step By Step Calculation With Examples